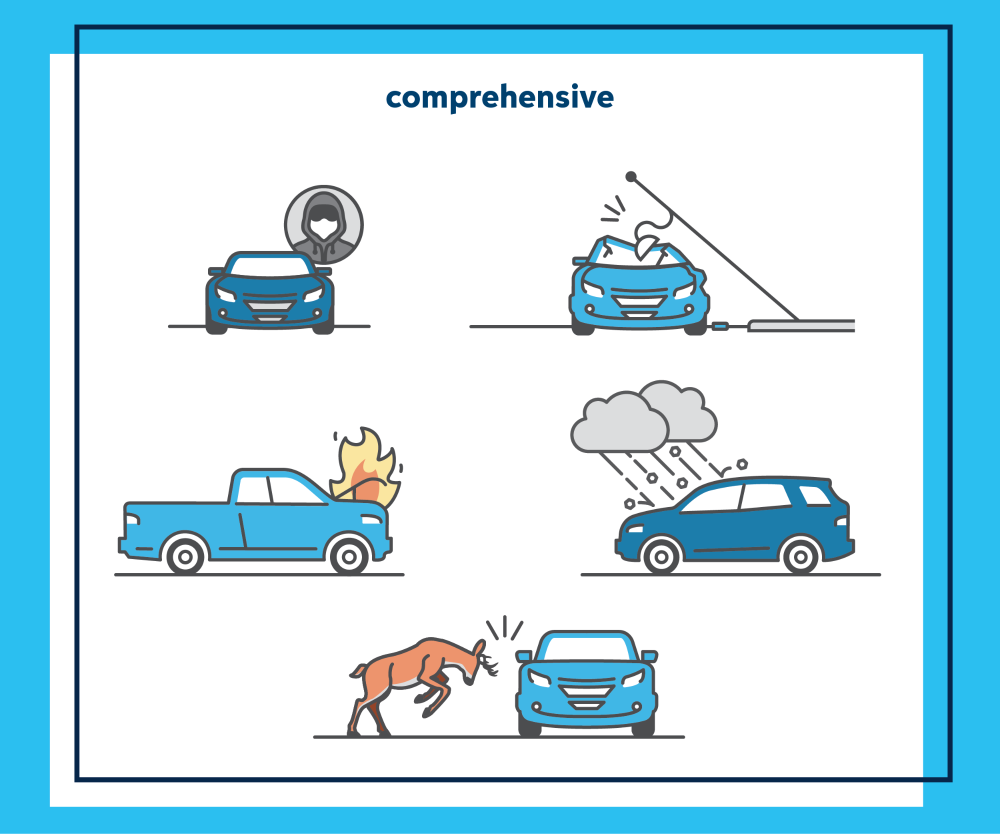

What is detailed insurance coverage? Comprehensive coverage aids cover the price of damages to your lorry when you're entailed in a crash that's not triggered by a crash. Comprehensive coverage covers losses like theft, vandalism, hail storm, and also hitting an animal. If you are driving and also hit a deer, the damages would certainly be covered under extensive insurance coverage.

Comprehensive insurance coverage is an optional coverage you can lug to help protect your lorry. Unlike some coverages, you don't choose a limitation for detailed.

/car-scratches-and-car-insurance-527084_final-01-a9a5aa68fa3a4a7b9bc24a5fc6cb5319.png)

All that indicates is that it may cover problems to your vehicle that collision coverage does not. Comprehensive coverage does not cover problems triggered by hitting one more vehicle or things.

It will certainly likewise not cover typical wear as well as tear on your lorry. Normal damage consists of items that normally need to be changed with time from use such as: Belts and hoses Brakes Tires Windscreen wipers Comprehensive Insurance coverage vs. Collision Protection Comprehensive coverage and collision coverage can be made use of to assist fix the damages triggered to your car in a mishap.

The insurance coverages differ in the scenarios in which they apply. Comprehensive coverage uses when: Your car hits a deer Someone takes your lorry Your vehicle is damaged in a hailstorm Collision protection uses when: You swerve to miss out on a pet dog and struck a fence One more car strikes your vehicle You have a single automobile loss with damages to the car Why should you purchase detailed coverage? Comprehensive coverage: Can be made use of no matter that's at fault Aids pay for fixings, over your insurance deductible, so you're not stuck paying the whole costs by yourself Is required by most lienholders along with crash insurance coverage.

Get This Report about Comprehensive Vs Third-party Car Insurance - Acko

What is a detailed deductible? A detailed insurance deductible is the quantity you've consented to pay prior to the insurer begins spending for problems. You can consider it as how much of the monetary threat you're ready to tackle if you're in a crash. Typically, the even more threat you're prepared to take (higher insurance deductible), the reduced your insurance policy expense would certainly be (automobile).

Allow's say there's a poor hailstorm in your area and also your car has $1,000 in damages. You have a $100 insurance deductible on your thorough coverage. You'll pay the very first $100, and afterwards your insurance coverage firm will certainly pay the remaining $900 of the car repair expense. If you have an older car, you might wish to think about whether you need comprehensive insurance coverage as it is generally limited to the real money worth of your car.

What Is Comprehensive Insurance coverage? It can assist pay for problems triggered by hailstorm, theft, fire or hitting an animal.

When you pay that, your vehicle insurance policy will cover the remainder of your costs, as much as your restriction. Allow's say your cars and truck is harmed as well as will set you back $6,000 to fix, and your insurance deductible is $1,000. You'll just pay out of pocket for the $1,000 deductible, and after that your insurance policy business will certainly pay the other $5,000 on your detailed insurance claim. insurance.

Concerns you can ask on your own to see if you need this protection are: Does your cars and truck lending institution call for comprehensive insurance coverage? If you rent or money, chances are they do, and you won't have the ability to get your vehicle without it. vehicle insurance. How much is your vehicle well worth? If it's less than what you would certainly pay for your insurance coverage premium, this coverage might not deserve it.

Unknown Facts About Comprehensive Vs Collision Insurance: Do You Need It?

What Is the Distinction In Between Comprehensive and also Accident Insurance? This is since both coverages shield your vehicle - insure. They cover different things.

An insurance deductible is the amount you should pay out-of-pocket before insurance spends for any costs, approximately the plan limitation. A higher insurance deductible methods you will pay more out-of-pocket when expenses emerge, but your month-to-month premium will be much less. A lower insurance deductible methods you will pay much less out-of-pocket when prices arise, but your month-to-month premium will certainly be more.

the quantity you will be able to pay if repairs are called for.

Detailed insurance coverage becomes part of what insurance providers sometimes call a "full-coverage car plan. cheap." Still, if you get or rent a brand-new lorry, you may require added coverage to round out its defenses. Here you'll learn more about this sort of insurance policy in wonderful detail, so you can determine whether it's a smart purchase for your vehicle or whether to do without.

Just How Detailed Car Insurance policy Works Let's say you arise from your residence after a windy evening to find that a tree branch has actually fallen onto your vehicle's roofing, leaving a substantial damage. Your extensive insurance covers this kind of damage, so you can submit an insurance claim and also await your payment.

Facts About Full Definition Of Comprehensive Insurance - Massachusetts Uncovered

Pick your deductible wisely because it puts on every claim you file. cheapest car insurance. Actual Cash Money Worth Payout Generally, thorough insurance coverage pays real cash money worth for your cars and truck if it is taken or fully completed by a protected danger such as a flooding. Note, this is not the quantity you spent for the cars and truck.

Most leasing business as well as loan providers require you to acquire the coverage for leased as well as financed automobiles. Lenders won't have much to state once you've made your last auto payment, however, and also it is up to you. Yet you should aim to your very own circumstance to make a decision (cars). If you can manage comprehensive insurance coverage, it may still be a great concept.

Crash Insurance coverage Several people are puzzled by having even more than one type of insurance coverage use to their vehicle. Crash insurance pays to repair or replace your car if it is damaged or totaled in a collision with an additional car or things.

Every U.S. state with the exception of New Hampshire requires its drivers to purchase liability insurance policy to drive legitimately. Accident as well as thorough are optional, also though nearly four out of five vehicle drivers select to buy these coverages. Collision coverage Crash pays for damage to your automobile arising from an accident with an item (e.

Crash protection reimburses you for the prices of fixing your auto, minus the insurance deductible. Comprehensive coverage Comprehensive covers damage to your auto triggered by disasters "other than collisions," and also costs dramatically much less than crash coverage.

Top Guidelines Of Comprehensive Coverage - Auto Insurance

What is extensive insurance coverage and also what does it cover? Comprehensive covers fixing or replacing your vehicle when it is harmed from a case besides colliding with one more car or object. When referring to a complete protection policy in car insurance coverage, it means a policy that consists of both detailed as well as accident, in addition to state-required coverage.

The cost is around $168 per year, according to the Insurance coverage Info Institute (Triple-I), which may be worth it to you for the extra monetary protection it supplies - cheap insurance. Frequently asked concerns, What is the difference in between comprehensive and also crash coverage? While detailed as well as collision insurance coverage are frequently abided with each other, they are 2 different protection options in an automobile insurance coverage policy.

Crash insurance coverage covers costs in the direction of fixing or replacing an automobile when there is damage from hitting one more lorry or object. Instances of collision insurance coverage consist of being included in a crash with an additional lorry or striking a mail box or tree. Both extensive and also accident have deductibles that are independent of each other.

As soon as you own your vehicle outright, then you may start to think about dropping it. If you stay in a state where there are a variety of hailstorm storms, wildlife, a higher crime area or a location vulnerable to flooding, then you must think about maintaining it as long as your spending plan enables. auto insurance.

How can I decrease my insurance prices so I can afford detailed insurance coverage? One of the most efficient ways of lowering the general price for an automobile insurance plan is to contrast quotes from multiple providers. Make sure to compare the very same insurance coverage options, including detailed, to ensure you are obtaining a true side-by-side contrast - cheap car insurance.

The Of Collision Vs. Comprehensive Car Insurance - Valuepenguin

Make certain to ask about all offered discounts, both with your current carrier or others you are considering, to help you discover the coverage you require at a cost that you can afford. affordable car insurance.

The cash we make assists us offer you accessibility to complimentary credit report and also records and also aids us create our other fantastic devices as well as instructional materials. Compensation may factor into exactly how and where items show up on our platform (and also in what order). But because we typically generate income when you find a deal you like and obtain, we try to reveal you provides we believe are a great suit for you.

Certainly, the offers on our system do not represent all financial Great site products out there, however our goal is to show you as lots of excellent alternatives as we can (car). If you're going shopping for vehicle insurance policy, you might be asking yourself whether you require to include detailed insurance policy to your vehicle coverage. Or perhaps you have actually lately financed an automobile and also your car finance lender needs you to obtain it.

But crash insurance coverage offers very various defense from comprehensive insurance policy. While detailed insurance covers noncollision events, crash protection assists spend for lorry fixings or replacement after your auto has actually been damaged in a collision. cheapest car insurance. This can consist of an accident with another car, a single-car mishap such as a rollover, or an accident with a stationary object like a fence.

If you finance or rent your auto, comprehensive insurance coverage will likely be obligatory. If your auto is paid off, you'll need to choose whether it makes feeling for you to get this optional coverage (cheaper car). Comprehensive insurance coverage might be a rewarding investment if you have a newer car and desire to aid protect your financial resources in instance of burglary or damages.

How Collision & Comprehensive Auto Insurance In California can Save You Time, Stress, and Money.

Otherwise, comprehensive protection may be worth the price for you. If you have an older auto with a reduced reasonable market worth, you could consider skipping detailed protection and decreasing your automobile insurance costs. To help you determine whether comprehensive protection would make good sense for you, search for the approximated market worth of your cars and truck.

She has even more than a decade of experience as an author and also editor as well as holds a bachelor's Read a lot more. Learn more.

My next-door neighbor decided to take apart as well as shed his old wood fencing. The problem is, the fire spread from his residential property to mine and torched parts of my fence, bushes, as well as shed. Whose home owners insurance coverage do I make an insurance claim on, mine or my next-door neighbor's?

You could assume thorough auto insurance policy sets you back even more than 3rd party or third event, fire and theft, yet that's not always the case - business insurance. Often extensive insurance is the. Our information shows that 51% of people that utilize Compare the Market can achieve a quote of 553 ** for an extensive annual policy.